Insurance teams already use AI for claims, fraud detection, pricing and customer service. Legal AI is now being used in the same way: to reduce manual effort in high-volume, rules-driven work.

In 2026, insurers will use legal AI to review policy wordings, support claims interpretation, assess underwriting risk, draft and compare agreements, and track regulatory change.

The problem is choice. The legal AI market has grown quickly. Some tools are built for law firms. Some are built for commercial contracting. Only a small number are built for insurance workflows, where exposure is financial, policy language is dense, and regulation never stops.

This guide explains what legal AI does in an insurance context, compares the leading platforms, and shows how to choose a tool that fits underwriting, claims and compliance work.

What is legal AI for insurance contract review?

Legal AI for insurance document review is software that analyses insurance policies, endorsements and related agreements to identify risk, interpret coverage, assess compliance and support decision-making.

In day-to-day insurance work, this includes:

Reviewing policy wordings and endorsements to identify exclusions, conditions, sub-limits, obligations and deviations from standard language

Supporting claims teams by mapping claim facts to policy language and highlighting areas of coverage, limitation or dispute

Supporting underwriting by comparing broker wordings, assessing risk positions and flagging non-standard clauses

Drafting and reviewing reinsurance, outsourcing and TPA agreements in line with approved positions

Checking policies and contracts against regulation to ensure they are up to date.

Read more: Can AI review legal contracts? Everything you need to know

Comparing the top legal AI platforms for insurance in 2026

Here is how the leading platforms stack up in an insurance context. Each platform has been assessed on:

fit for insurance workflows (policy review, claims support, underwriting, compliance)

ability to scale across the business (not just within legal)

control, auditability and regulatory readiness

practical day-to-day usability

Platform | Policy wording review | Claims interpretation support | Underwriting support | Playbooks and standards enforcement | Regulatory scanning and mapping | Bulk or portfolio review | Anonymisation before processing | Integrations | Insurance specific fit |

|---|---|---|---|---|---|---|---|---|---|

LEGALFLY | Yes - full policy structure, endorsements and schedules | Yes - maps facts to cover and exclusions | Yes - compares broker and partner wordings | Yes - built-in playbooks and guardrails | Yes - tailored regulatory and legislative alerts | Yes - multi-document review | Yes - anonymised before any processing | Yes - native Word, SharePoint, Outlook, Copilot, Slack, Google Drive | High |

Harvey | General document review only | Limited - manual interpretation | Manual - no insurance structure | No | No | Yes | No | Word, Outlook, SharePoint | Low |

Kira by Litera | Limited - clause extraction only | No | No | No | No | Yes - strong portfolio extraction | No | No | Medium (portfolio use only) |

Luminance | General contract review | No | Limited - depends on configuration | No | Limited - compliance monitoring only | Yes | No | Limited | Medium |

LexCheck | No - not policy focused | No | No | Yes - based on historical redlines | No | No | No | Word add-in only | Low |

LegalOn | Standard contract review only | No | No | Yes - playbook driven | Limited | Limited | No | Word plugin | Low to Medium |

Spellbook | General contract review | No | No | No | No | No | No | Word only | Low |

Robin AI / LegalSifter | No - general contracts only | No | No | No | No | Limited - search and extraction | No | No | Low |

Contract PodAI | General contract review via CLM | No | Limited - operational contracts only | Yes - clause libraries | Limited | Yes - via CLM repository | No | Limited | Medium |

LEGALFLY - best overall choice for insurance legal teams

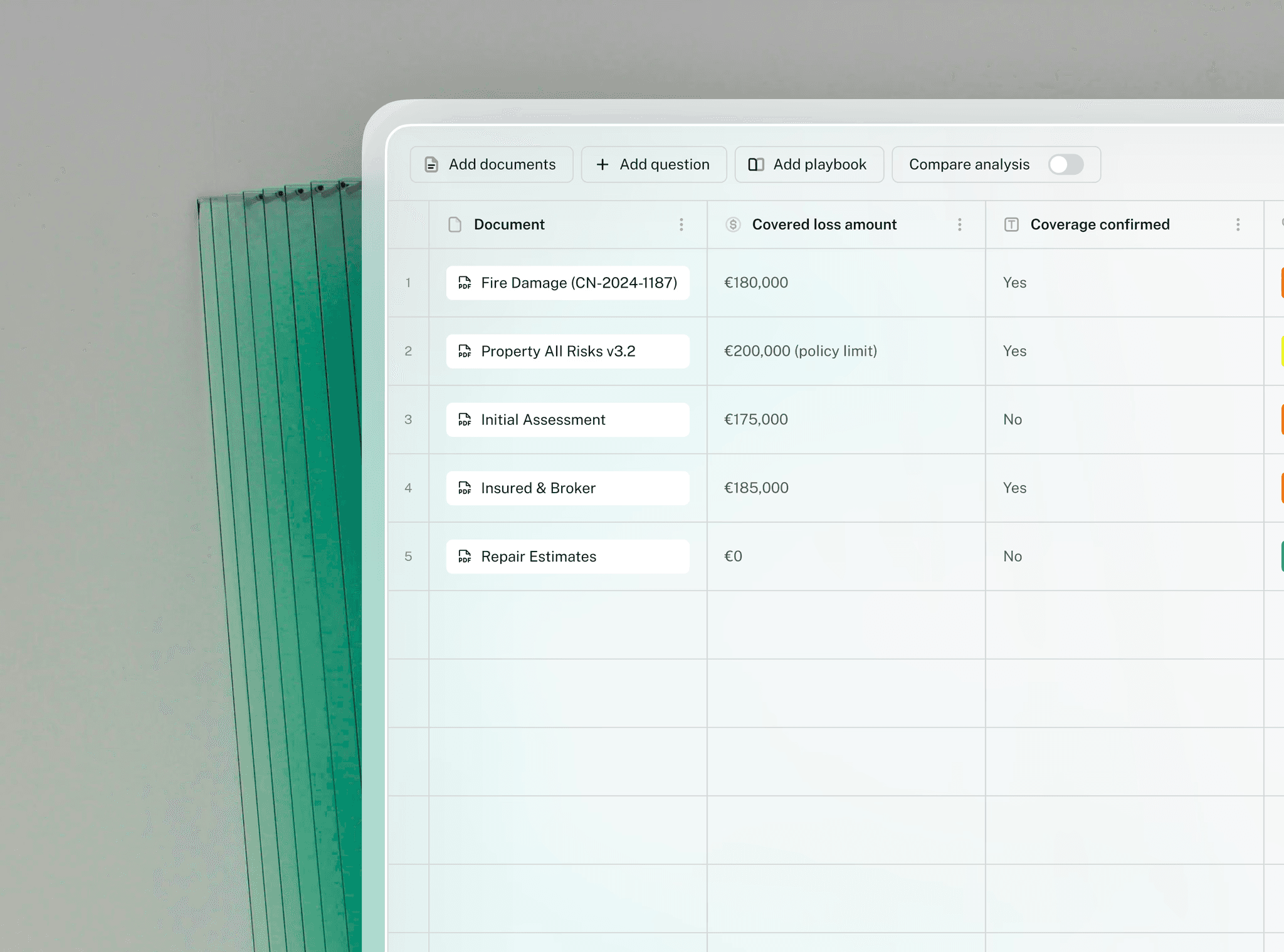

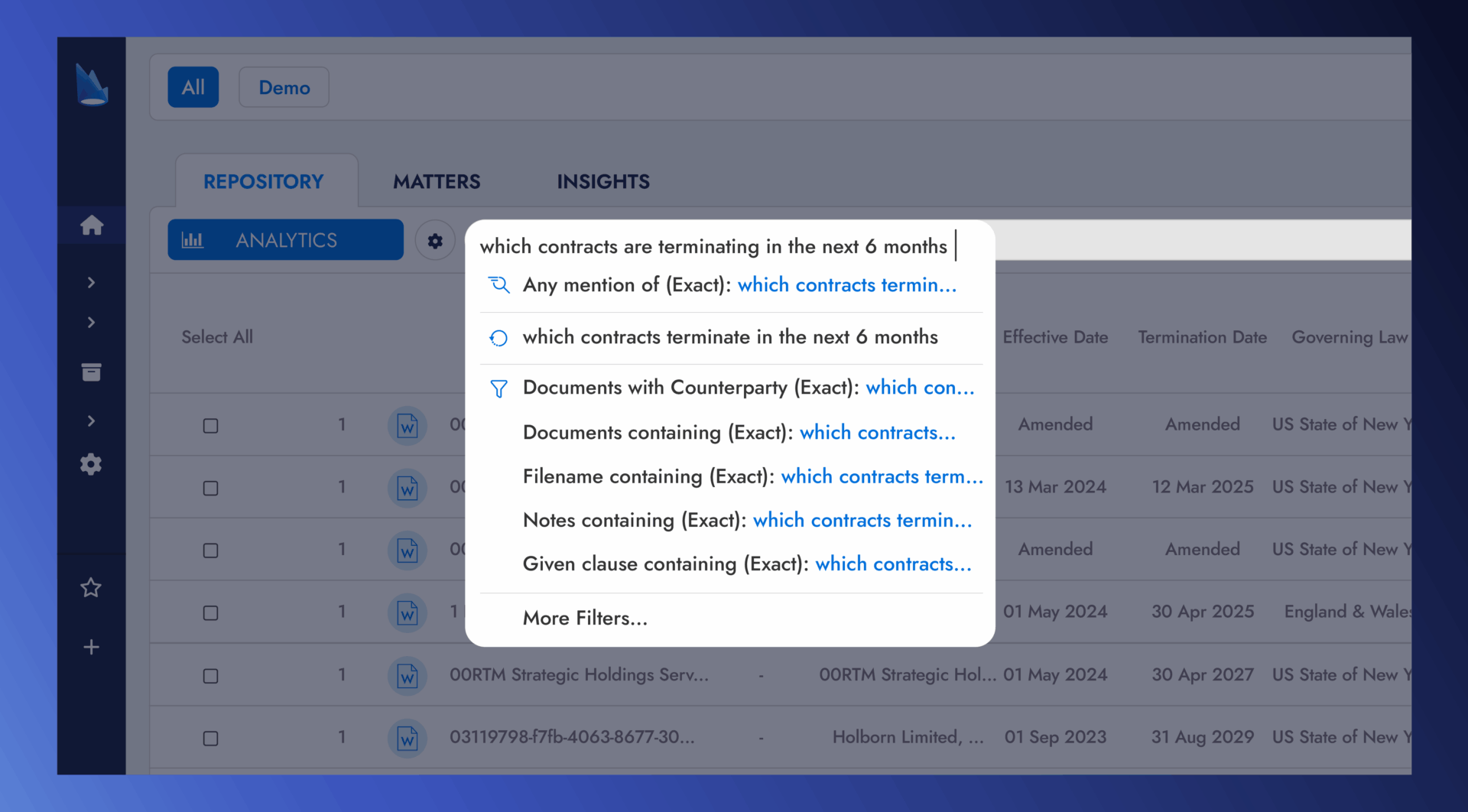

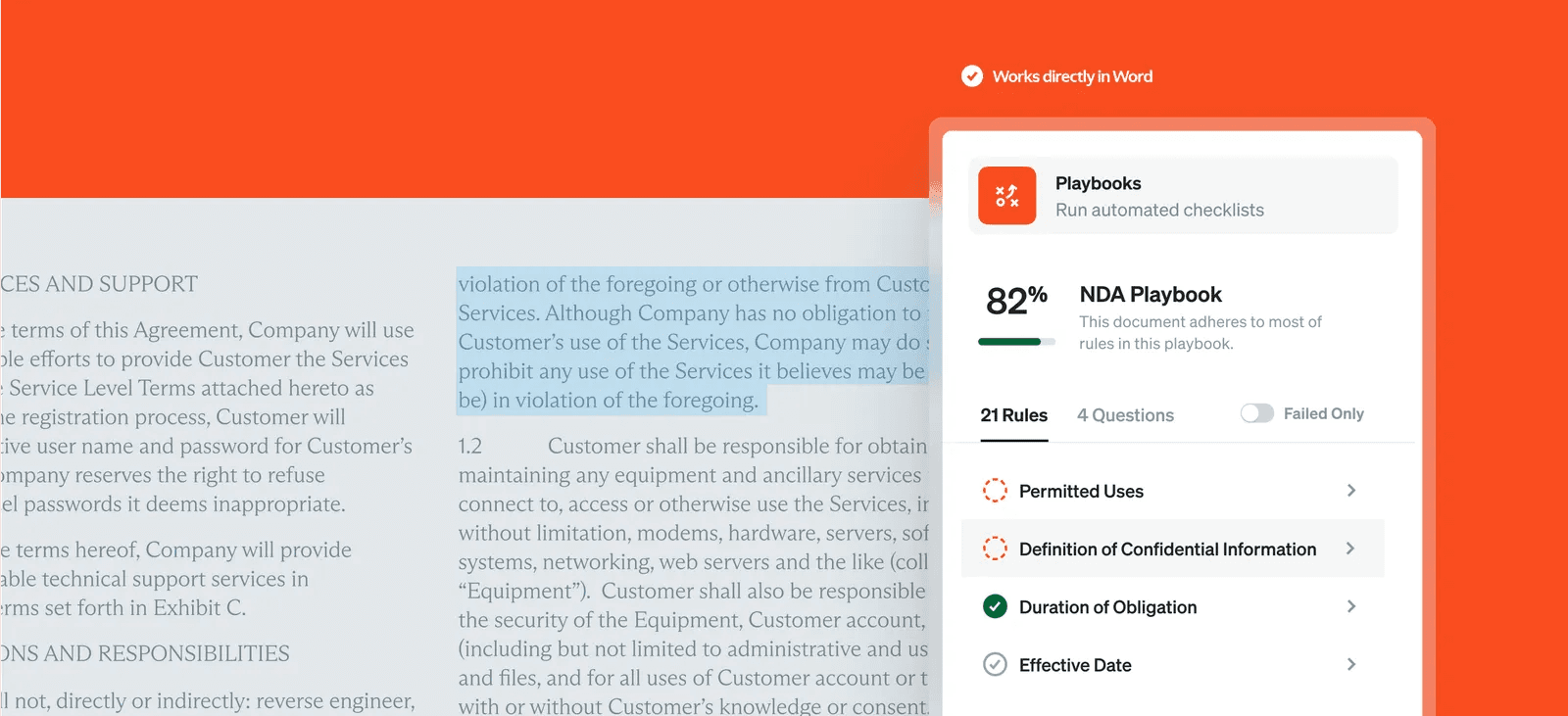

LEGALFLY is a secure legal AI workspace for insurance teams that want faster contract work without losing control. It helps legal and compliance teams review and compare policy wordings and endorsements, draft consistent clauses from templates, run bulk checks across large contract sets, and produce source linked outputs that are easy to audit.

It runs in Word, SharePoint and Teams, so version control and document discipline stay intact.

Importantly, it is the only mainstream legal AI platform designed to anonymise documents before processing. That means policies, broker wordings, outsourcing contracts and other sensitive documents can be analysed without exposing personal or confidential data.

Legal Radar adds regulatory monitoring, so you can track changes and understand what documents and playbooks may need updating.

The result is faster review cycles, more consistent positions across the business, and clearer oversight of regulations.

Harvey - general assistant, less insurance-specific

Harvey is a legal AI assistant used for research, drafting and internal knowledge work. You might use it to sense-check regulatory issues, draft commercial agreements or prepare internal memos. It performs well as a general legal assistant.

Where it falls short for insurance is operationalisation. Policy comparison, claims interpretation and underwriting support require structure and repeatability. With Harvey, that layer is something you have to design, govern and police yourself.

Read more: Harvey AI vs LEGALFLY: which legal AI is right for your team?

Kira - for large-scale clause extraction and portfolio work

Kira is often used for clause extraction and analysis across large document sets. Insurers use it for book transfers, M&A due diligence, legacy policy reviews and portfolio clean-ups.

It is not designed for day-to-day underwriting support, claims handling or live drafting. You use Kira for big analytical exercises, not as the backbone of daily insurance legal operations.

Luminance - contract automation with AI analysis

Luminance is an AI platform for automating contracting workflows. In insurance, it is typically used for contract review, portfolio visibility and automation across commercial agreements.

It can support large-scale reviews and gives oversight across contract estates. As with Kira, its strength is in analysis and automation rather than in supporting underwriting and claims workflows. Insurance-specific value depends heavily on configuration.

LexCheck - first-pass review

LexCheck focuses on reviewing contracts in line with how your team has historically redlined. Insurance legal teams use it mainly for vendor, supplier and outsourcing agreements.

It can reduce time on routine commercial reviews. It is less relevant for policy wording, claims interpretation or regulatory workflows. It improves legal efficiency, but does not reshape how legal supports the insurance business.

Spellbook - fast drafting support for individual lawyers

Lawyers use Spellbook to draft and revise contracts in Microsoft Word. In insurance, it is used for commercial contracting and internal agreements.

It is quick to adopt and useful for individual productivity. It does not enforce standards, manage risk or support underwriting and claims teams.

Robin AI - accessible contracting tools

Robin AI is used for standard commercial contracts and business-facing work. It can help with drafting, reviewing and negotiating routine agreements.

It is accessible and relatively easy to deploy. It is not designed for policy language, claims interpretation or regulatory work.

How to choose the best legal AI for insurance

In insurance, policy language is dense, liabilities are financial, and regulatory exposure is continuous. The legal AI platforms that perform well in insurance are built with this in mind. They can handle long, layered documents, support operational teams, and embed compliance into daily workflows.

When assessing tools, focus on four things: review depth, insurance workflow coverage, regulatory capability, and enterprise readiness.

Contract and policy review depth

More complex than standard commercial contracts, insurance documents combine base wordings, endorsements, schedules and definitions into a single legal instrument. The right legal AI can:

Analyse full policy structures, not isolated clauses

Interpret how endorsements and schedules modify base cover

Recognise jurisdiction-specific drafting and regulatory language

Detect changes in legal meaning, not just wording

Insurance workflow coverage

A good platform will support:

Policy comparison and version control

Claims coverage interpretation

Underwriting review of broker and partner wordings

Delegated authority and outsourcing agreements

Compliance and regulatory support

Insurance legal teams operate in a permanent regulatory cycle. Good platforms support:

Horizon scanning across insurance-relevant regulation

Mapping regulatory change to policies, contracts and playbooks

Regulator-ready outputs with sources and audit trails

Integrations, security and scalability

For legal AI to work in insurance, it needs to fit existing systems and meet enterprise standards. Look for:

Native integration with Word, SharePoint, Outlook and document systems

Anonymisation before analysis to protect sensitive data

Flexible deployment models for privacy and sovereignty

The ability to extend legal standards into underwriting and claims safely

Read more: Everything you need to know about agentic AI for legal work

Final verdict: the best legal AI for insurance contract review and drafting in 2026

LEGALFLY is the best option for insurers that need speed and control.

It helps legal and compliance teams review and compare policy wordings and endorsements, draft and redraft clauses in line with approved positions, and run bulk checks across large document sets. Outputs are source linked and audit ready, which supports internal governance and regulator scrutiny.

The key differentiator is anonymisation before processing. Policies and related documents often contain personal and sensitive data. LEGALFLY removes that data before any AI work starts, so teams can use it on real insurance documents without increasing privacy risk.

Combined with Microsoft native workflows in Word, SharePoint and Teams, it is the most practical platform to roll out across underwriting, legal and compliance without changing how people work.

FAQs about legal AI for insurance contracts

Can AI review insurance policies accurately?

Yes, when it is built for insurance. LEGALFLY reads base wordings, endorsements and schedules together, and flags changes in legal meaning, not just wording. That is important for coverage decisions and audit.

What features should insurance companies look for in legal AI software?

Four matter most:

Policy and endorsement review, not just clause extraction

Multi document review for policy comparison and data extraction

Regulatory tracking linked to contracts and policies

Strong security and audit trails

How secure is legal AI when handling sensitive insurance contract data?

It depends on the platform. LEGALFLY anonymises all data before processing, runs within your environment and meets enterprise security standards.

What types of insurance contracts can legal AI review?

Policies and endorsements, reinsurance agreements, TPAs, delegated authority agreements, outsourcing contracts, broker agreements, supplier contracts and regulatory documentation.

How long does it take to implement legal AI in an insurance legal team?

It depends on the platform. LEGAlFLY can be deployed quickly. Teams often start reviewing documents the same day. The biggest impact comes from setting up playbooks and workflows, which then deliver consistent, scalable results across the business.

Note: We carried out this research in Q1 2026. For the most up to date information, contact the supplier directly.