Most legal AI tools were built for standard commercial contracts or litigation workflows. They are not designed for transaction-heavy financial work, where legal decisions directly affect exposure, capital treatment, pricing, and regulatory compliance.

But legal AI can make a meaningful difference in financial institutions. It can reduce review time across long, technical agreements, improve consistency across negotiation rounds, flag non-standard risk positions early, and support regulatory and compliance analysis without increasing headcount.

A small number of platforms are built with the requirements of finance legal teams in mind. This guide explains how legal AI is used in finance, compares the leading platforms, and sets out how to assess whether a tool is suitable for complex financial contracts.

What is legal AI for finance contract review?

In a finance context, legal AI reads, analyses, and compares financial contracts to identify risk, support negotiation, and ensure compliance with internal standards and regulation.

Finance teams use legal AI to review drafts, compare versions across negotiation rounds, flag non-standard positions, draft and redraft clauses, and support compliance and risk analysis. When it is well implemented, it increases review capacity and improves consistency across transactions.

Read more: Can AI review legal contracts? Everything you need to know

Compare the top legal AI platforms for finance in 2026

Platform | Contract review (complex agreement) | Drafting support | Playbooks / standards | Regulatory change mapping | Bulk / portfolio analysis | Pre-processing anonymisation | Microsoft Word integration | Explainable outputs / auditability |

|---|---|---|---|---|---|---|---|---|

LEGALFLY | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Kira (Litera) | Yes | Yes | No | No | Yes | No | No | No |

Luminance | Yes | Yes | No | No | Yes | No | Yes | Partial |

LegalOn | Yes | No | Yes | No | Partial | No | Yes | Partial |

LexCheck | Yes | No | Yes | No | No | No | Yes | Partial |

Spellbook | No | Yes | Yes | No | No | No | Yes | No |

LegalSifter | Yes | No | Yes | No | No | No | Yes | Partial |

Contract PodAI | Yes | Yes | Yes | Partial | Yes | No | Yes | Partial |

LEGALFLY - built for regulated finance workflows

LEGALFLY is built for in-house legal teams in regulated financial institutions. It is designed for complex, transaction-heavy work where accuracy, consistency, and auditability are non-negotiable.

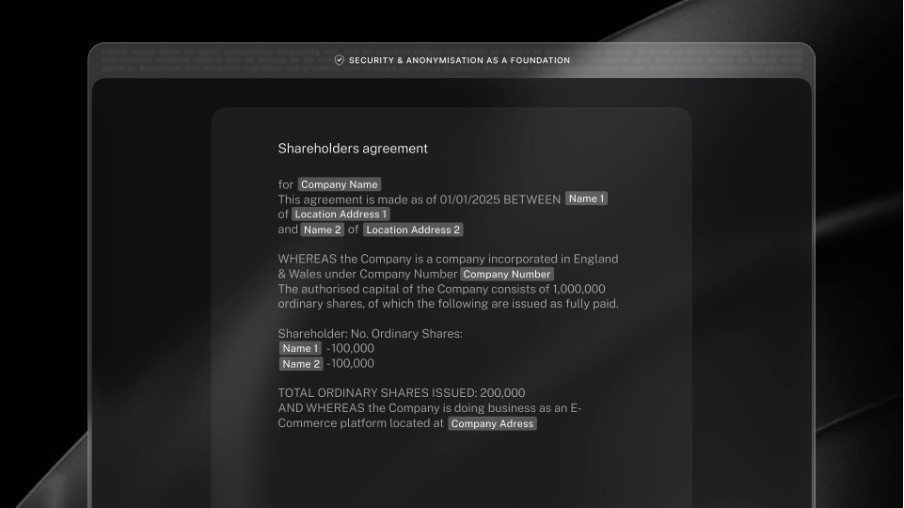

It is the only legal AI platform that anonymises documents before processing. Client data, counterparty details, and confidential deal terms are removed before any AI analysis begins. This allows teams to use AI on live transactions without exposing sensitive information, which is often a requirement for internal approval in banks and asset managers.

LEGALFLY is used to review and compare credit agreements, derivatives documentation, outsourcing contracts, and regulatory material. It applies playbooks to enforce approved positions, flags deviations, and links every output directly to source text. All reasoning is visible and auditable.

Regulatory scanning is built in. Teams can receive automated alerts about updates in financial regulation and then compare contracts against the changes to see if revisions need to be made.

LEGALFLY runs inside Word, SharePoint, Outlook, and Teams, preserving existing document control, permissions, and audit trails. Request a personalised demo.

Kira by Litera - bulk clause extraction and legacy book analysis

Kira is used for large document sets such as M&A, portfolio analysis, book migrations, and remediation projects. It extracts clauses, obligations, and data from thousands of contracts.

It is not a transaction tool. It is not used to negotiate, draft, or manage live deals. It is used when there is a large legacy estate that needs to be structured and analysed.

Kira fits banks and asset managers running remediation, migrations, or acquisitions. It solves legacy contract chaos and obligation mapping problems.

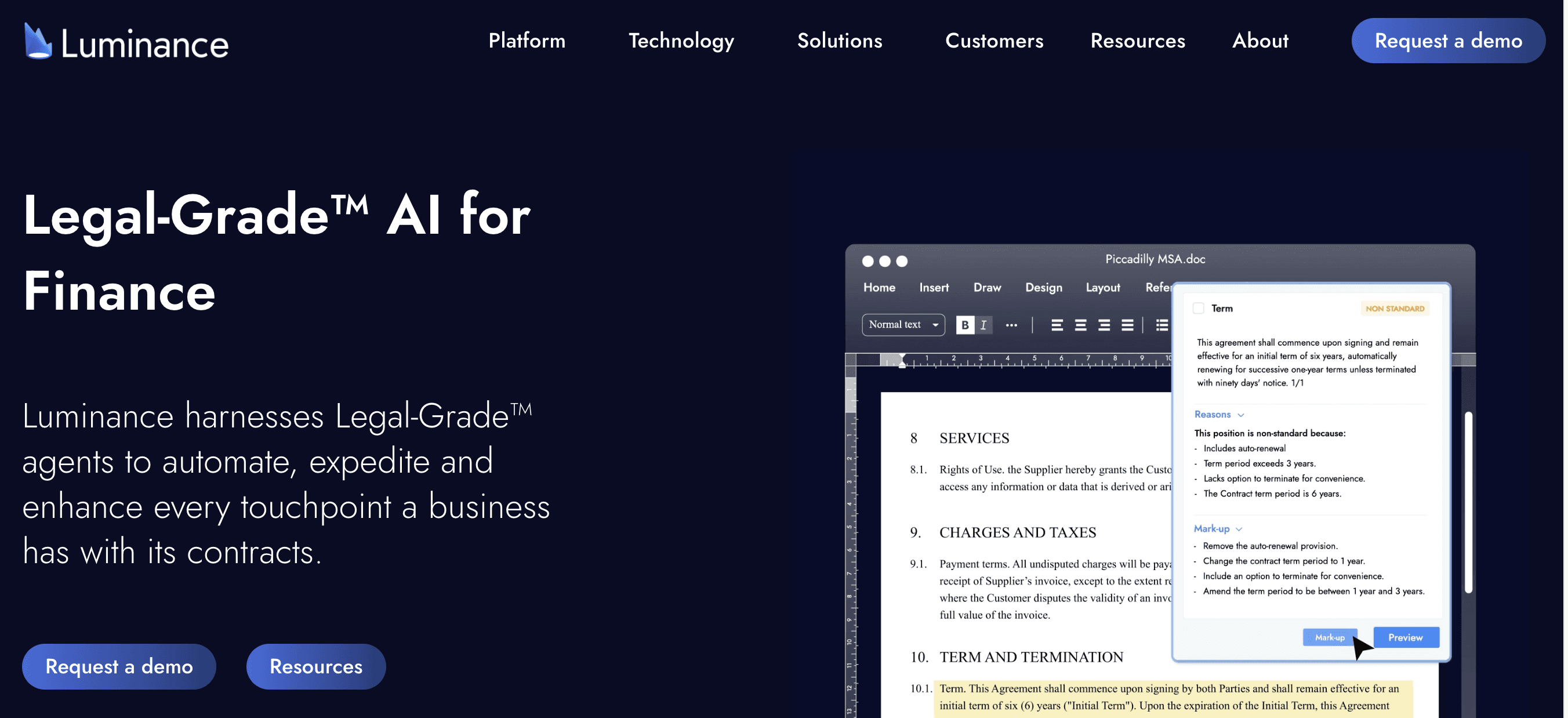

Luminance - enterprise contract analytics and compliance programmes

Luminance is a contract intelligence platform used for review, analysis, and compliance across large contract estates. In finance, it is typically used to gain visibility, support compliance reporting, and run large review exercises.

It can be effective at scale, but it is not finance-specific. Most deployments require configuration to handle financial contract structures and terminology properly.

Luminance fits large institutions running enterprise contract programmes and helps address visibility and compliance reporting gaps.

LegalOn - structured review for standard contracts

LegalOn focuses on playbook-based review and intake workflows. Finance teams use it mainly for operational contracts and internal workflows.

It is not designed for derivatives, structured finance, or heavily negotiated financial instruments.

It fits legal teams handling high volumes of routine agreements and helps reduce intake bottlenecks and inconsistent review.

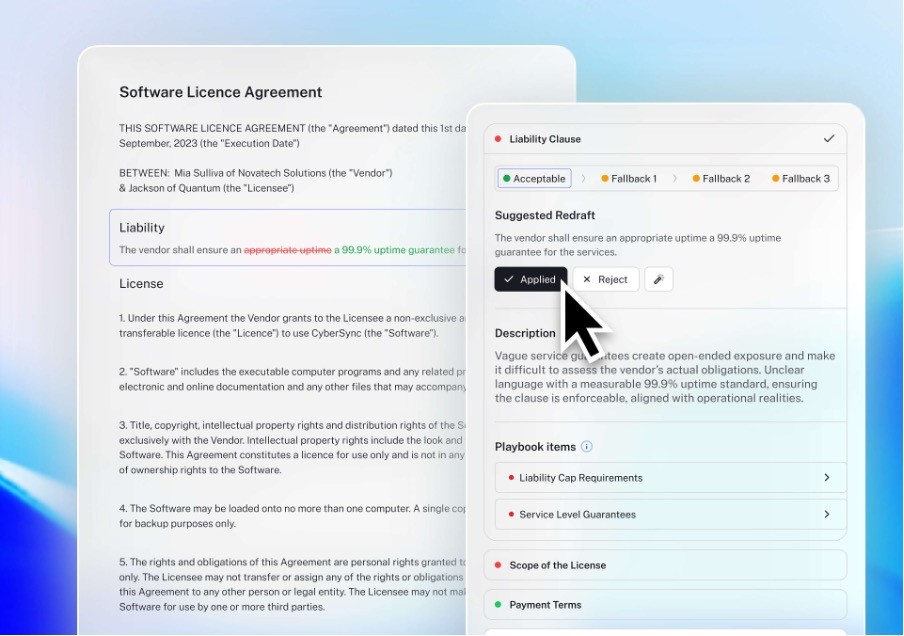

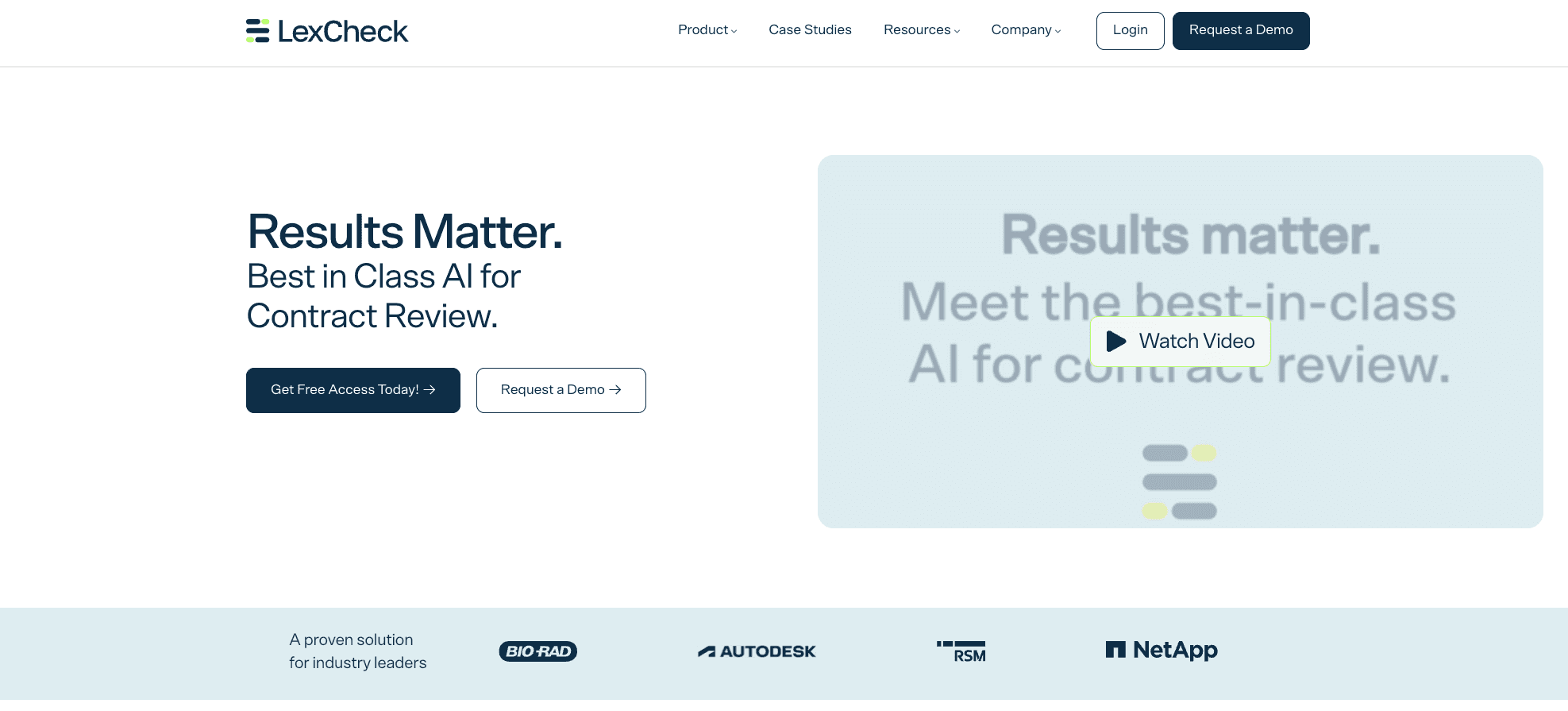

LexCheck - enforcing historical redlines at speed

LexCheck reviews contracts based on how a team has historically redlined. In finance, it is used for vendor contracts, NDAs, and operational agreements.

It enforces consistency and reduces manual first-pass review. It is not used for complex financial instruments.

LexCheck fits teams with high volumes of similar contracts and helps reduce inconsistency.

Spellbook - drafting help for individual lawyers

Spellbook operates inside Word and supports drafting and redrafting. It suggests clauses and rewrites language.

It does not support regulatory workflows, bulk review of documents and can struggle with jurisdictional nuance. It is mainly used as a productivity tool for individual lawyers.

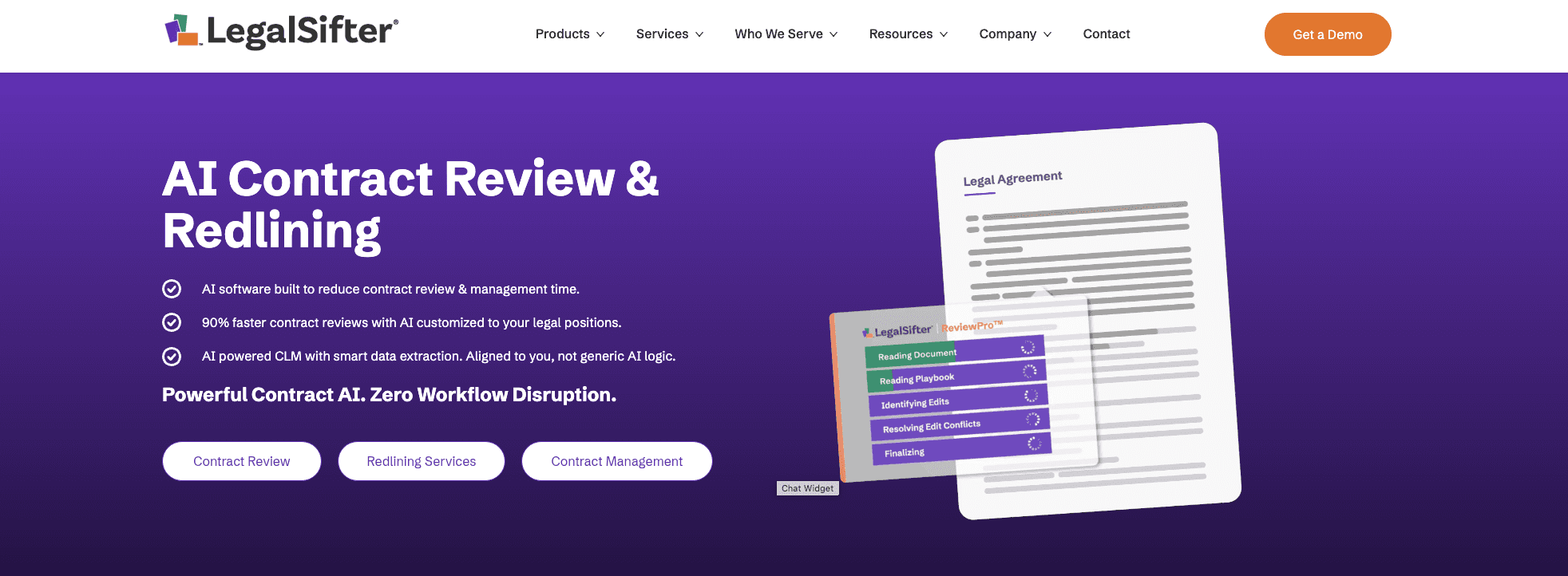

LegalSifter, ContractPodAI - general contract tools

These platforms focus on contract search, review and lifecycle management. They are used for organising contract estates and improving access to information.

They are useful for general contracting. They are not designed for the structure, complexity or regulatory demands of finance contracts.

How to choose legal AI for finance work

Finance legal teams sit inside business units and spend a lot of time on contracting. Documents are long, technical and negotiated over many rounds. The job is often risk control, not closing deals faster. Here’s how to choose a legal AI to reflect that.

Step 1: pick the workflow you want to fix first

Start with one problem that takes up your time and creates risk. Ask:

Which contract types consume the most time? NDAs, credit docs, derivatives, outsourcing.

Where do errors happen? Missed deviations, approvals, version confusion, inconsistent positions.

Which teams need support? Legal only, or legal plus risk, compliance and the front office.

Step 2: test it on negotiation rounds, not single documents

Most tools look fine on a clean first draft. Ask:

Can it compare round 3 vs round 7 and show what changed in meaning, not just wording?

Can it generate an issues list that a deal team can act on?

Can it produce a clean summary for stakeholders without inventing details?

Step 3: check how standards are enforced

Consistency is important. Ask:

Can it apply approved positions and fallback language from a playbook?

Can it flag deviations clearly and explain why they matter?

Can it keep style consistent across the team?

Step 4: confirm security and data handling

Security needs to be built in. Ask:

Does it anonymise documents before processing?

Can it run in your environment, with your access controls and logging?

Is any data used for training, and what is the default?

Step 5: validate auditability

Finance teams need defensible outputs. Ask:

Does every output link back to source text?

Does it show reasoning in a way that can be reviewed later?

Can it export review results for audit and governance records?

Step 6: check integration with how legal actually works

Adoption often fails when tools sit outside the document workflow. Ask:

Does it work in Word and connect to where you store your documents (SharePoint, Google Drive)?

Does it respect document permissions and version control?

Does it support exports for reporting and stakeholder sign-off?

Step 7: run a short proof using your hardest documents

Use real documents and real negotiation history. Ask:

What is the time saved on a typical review?

What gets missed or misread?

How much configuration is needed before results are reliable?

The best platforms handle negotiation rounds, enforce standards, protect data by design and produce audit-ready outputs inside existing workflows.

Read more: Everything you need to know about agentic AI for legal work

Final verdict: the best legal AI for finance contract review and drafting in 2026

For banks, asset managers, and financial institutions that need to increase capacity without increasing exposure, LEGALFLY is the best option.

Built for regulated, transaction-heavy environments, it supports complex agreement review, applies playbooks to enforce approved positions, anonymises data before processing, and links regulatory change to affected contracts. It runs inside Word, SharePoint, Outlook and Teams, which supports document control and audit requirements.

FAQs about legal AI for finance contracts

What is the best legal AI for finance contracts?

For regulated finance workflows, LEGALFLY is the strongest option. It is built for complex agreements, risk control and regulatory support, not just drafting speed.

How does legal AI help with finance contract drafting?

It accelerates drafting by applying approved language, suggesting clauses and tracking deviations across negotiation rounds. Strong platforms also enforce standards and highlight risk.

How secure is legal AI when handling sensitive financial data?

Security varies by platform. Finance teams should look for anonymisation before processing, in-environment deployment and independent security certification. Customer and transaction data should not be exposed.

Can legal AI replace in-house legal teams in finance?

No. Legal AI supports lawyers. It does not replace judgement, accountability or regulatory responsibility.

How much does legal AI software for finance cost?

Pricing is typically subscription-based and varies by scope, users and deployment model.

Note: We carried out this research in Q1 2026. For the most up to date information, contact the vendor directly.