In this article:

Why DORA matters for tech companies

What happens if you are not DORA compliant?

Four key areas to focus on for DORA

DORA compliance, done faster: how LEGALFLY helps you meet requirements

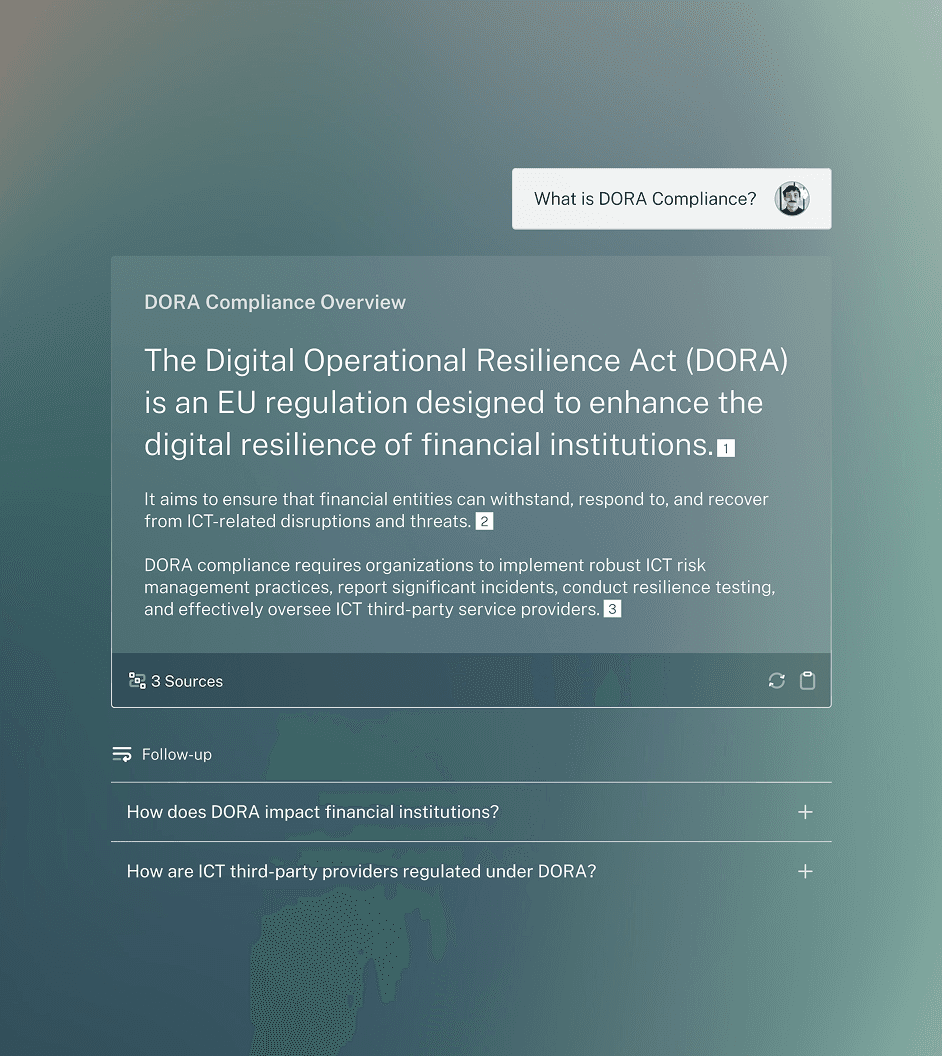

The Digital Operational Resilience Act (DORA) is now in effect across the EU. While it targets financial institutions directly, its impact extends to every tech company that supports them. If you provide cloud hosting, data services, cybersecurity tools, or any other ICT capability to a regulated firm, DORA likely affects you.

Here’s what you need to know to stay compliant and avoid unnecessary risk.

Why DORA matters to tech companies

DORA was introduced to improve the digital resilience of the EU’s financial system. It applies to banks, payment providers, trading venues, insurers, and crypto-asset platforms. But it also places indirect obligations on their suppliers, including third-party ICT providers.

While tech providers are not the primary targets, they are still indirectly affected in two key ways:

1. Through contractual requirements:

Regulated financial firms are now required under DORA to manage third-party ICT risk more strictly. This means they must ensure their suppliers (cloud platforms, SaaS companies, cybersecurity vendors, etc) meet specific standards around:

Risk controls

Incident reporting

Audit rights

Operational resilience

Data access and recovery

Exit and substitution clauses

2. If designated as Critical Third-Party Providers (CTPPs):

The European Supervisory Authorities (ESAs) can designate certain large or essential ICT providers as critical to the financial system. If this happens, the provider may be subject to direct DORA oversight, including audits and enforcement actions.

This means if your technology supports a financial service, your contracts, processes, and response protocols will come under scrutiny. DORA came into force on 17 January 2025, with enforcement ramping up from May.

Read more: A simple guide to navigating DORA compliance

Or, watch the webinar, DORA compliance beyond January: What’s next?

What happens if you are not DORA compliant?

Failing to meet DORA standards can lead to serious consequences:

Fines of up to 2% of global turnover

Contract risks and delayed deals with regulated customers

For providers classified as critical, direct penalties of up to 5 million euros

Reputational damage and reduced access to financial markets

Four key areas to focus on for DORA

To help your financial clients meet their own DORA obligations, you need to address four main areas:

1. ICT risk management

You should be ready to define roles, responsibilities, and risk controls clearly in your contracts. Clients will ask how you manage downtime, cyber threats, and system failures. Make sure your internal policies match what your contracts say.

2. Incident reporting

Significant ICT incidents need to be reported quickly and clearly. Your clients will need to notify regulators, so your contract should set out reporting timeframes, escalation routes, and the level of detail required.

3. Resilience testing

Financial institutions must test their operational resilience regularly. This may include penetration testing, disaster recovery drills, and live failover testing. Your contracts may need to commit to testing schedules and participation in coordinated exercises.

4. Contract terms

Regulators expect detailed, transparent contracts. You should include exit clauses, subcontracting conditions, data access rights, and audit provisions. These terms help your clients maintain control and accountability, which is a core DORA requirement.

DORA compliance checklist for tech companies

Use this checklist to show your organisation is DORA-ready:

Review ICT contracts for required clauses: audit rights, data access, subcontracting limits and exit terms

Align internal risk management processes with contractual commitments

Formalise incident escalation procedures and client reporting protocols

Schedule and document regular resilience testing

Maintain a clear inventory of critical third-party suppliers and their risk status

Keep audit-ready records of decisions, reviews and compliance actions

Equip sales and account teams to respond to DORA-related due diligence requests

Meeting these expectations consistently and at scale is not straightforward. It requires careful coordination between legal, compliance, procurement and commercial teams. That’s where LEGALFLY adds real value.

DORA compliance, made faster: how LEGALFLY helps tech companies meet and prove DORA readiness

LEGALFLY is a legal AI platform that helps tech companies manage high-volume contract work with greater speed, accuracy and control. For teams working to meet DORA obligations, LEGALFLY supports both compliance and client assurance.

Read more: DORA compliance made easy with legal AI

At the core of LEGALFLY are AI agents. These specialised functions are trained to complete specific legal tasks such as reviewing contracts, rewriting clauses, comparing versions, or answering questions about regulations like DORA. Each agent is designed to perform a task reliably, repeatably and in line with company policies and regulatory standards.

Dedicated DORA Compliance Agent: LEGALFLY has a purpose-trained agent for DORA compliance. It analyses thousands of third-party vendor agreements at once and flags non-compliant terms. When gaps are identified, the agent can automatically redraft clauses or entire contracts to bring them in line with regulatory expectations.

Review contracts through a DORA lens: LEGALFLY's DORA-trained agents analyse ICT agreements to identify missing or weak clauses. These include audit rights, subcontracting limits, data access terms and exit provisions. When gaps are found, agents can suggest or redraft language to bring contracts in line with regulatory expectations.

Support your clients’ compliance efforts: Financial institutions must show that their third parties are DORA-ready. LEGALFLY helps you provide clear, compliant contract language that meets client requirements. This reduces redlines, accelerates procurement and builds trust during negotiations.

Maintain oversight of your own ICT suppliers: As a tech provider, you are also responsible for managing risk in your own vendor ecosystem. LEGALFLY reviews supplier contracts to confirm critical protections are in place and maintains a central, up-to-date repository for easy access and oversight.

Create structured, auditable compliance workflows: LEGALFLY allows you to build DORA-specific playbooks tailored to your obligations and client needs. These guide its AI agents to check for risks, enforce consistent terms and maintain a full audit trail across every contract reviewed.

Explain DORA in plain language: With LEGALFLY’s Discovery Agent, you can explore how DORA applies to your business. Ask questions in natural language and get accurate responses grounded in the official regulation.

Visit the Agent Store for more information on LEGALFLY agents.

Stay compliant, build trust and scale faster with LEGALFLY

DORA marks a shift in how regulators and clients expect technology providers to manage operational risk. If your platforms or services support essential financial functions, you are now expected to show greater control, transparency and contractual clarity.

For tech companies, that means updating agreements, formalising incident processes and ensuring internal compliance matches external obligations. These steps reduce exposure and make your organisation easier to trust and do business with.

The challenge is scale. Manual reviews, scattered processes and one-off tools cannot keep pace with regulatory expectations.

LEGALFLY helps teams meet DORA requirements faster. Its AI agents review contracts, apply structured compliance checks, generate documentation, and keep your processes aligned with evolving standards like DORA without adding unnecessary overhead.